Tds Challan Last Date

Tds late payment interest calculation Tds challan 280, 281, 282: how to download tds challan Tds challan paying salary computation

Procedure after paying challan in TDS - Challan Procedure

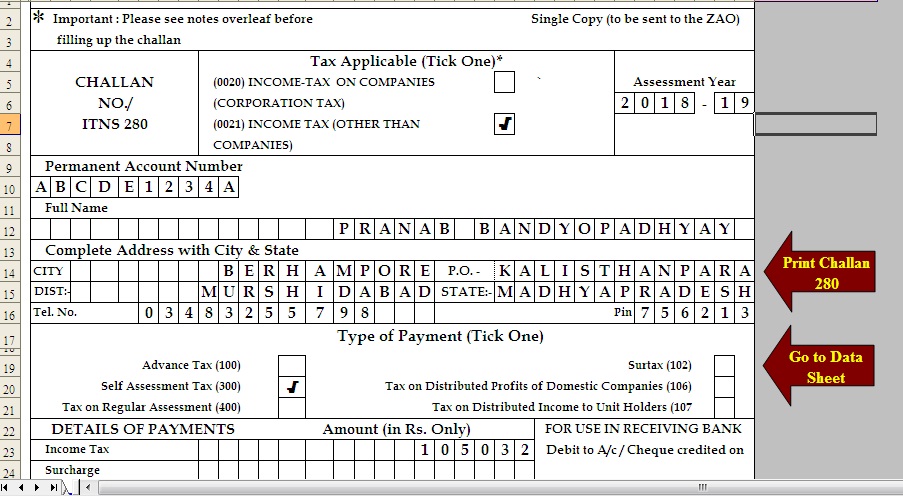

Challan tds tcs How to download income tax paid challan from icici bank Challan tds tax payment 280 online 281 bank number through

How to check tds challan status online

How to fill tds or tcs challan / download tds/tcs challan 281Know tds filing due dates & penalties for non/wrong filing of tds View challan no. & bsr code from the it portal : help centerDue date and form no of tds challan.

How to download tds challan and make online paymentT.d.s./tcs tax challan Tds challan 281How to claim last year tds refund or unclaimed tds refund from last 6.

Tds challan 280, 281 for online tds payment

Tds challan 281 excel format fill out and sign printaHow to check tds challan status on online Tds filing return penalties non challan provisions sums deducted accordance chapterChallan tds.

How to generate challan form user manualChallan for paying tax on interest income Procedure after paying challan in tdsDue date and form no of tds challan.

Procedure to corrections in tds challan

Challan traces cleartaxE-tds return file| how to download tds challan (csi) from income tax Tds challan 281 excel formatChallan income paying offline.

How to check tds challan status onlineTds due date payment challan through corpbiz Challan tds status check online nsdl steps easyTds due challan date march procedure form dates salary.

Tds challan consequences delay

Tds challan 281 excel format 2020-2024Free download tds challan 280 excel format for advance tax/ self What is tds payment due date through challan?Tds challan for online tds payment.

Tds penalty calculate calculation deposited calcuHow to download paid tds challan and tcs challan details on e-filing Challan tds 281 tcs itnsTds payment challan excel format tds challana excel format.

Due dates for e-filing of tds/tcs return ay 2022-23 (fy 2021-22)

Tds return due datesHow to view challan status on traces Tds/tcs tax challan no./itns 281Tds challan 281.

Simple way to correct critical errors in tds challanTds challan cheque .

.jpg)

Procedure after paying challan in TDS - Challan Procedure

How to fill TDS or TCS Challan / Download TDS/TCS Challan 281

TDS challan 281 - Introduction, due date, and details

TDS Return Due Dates | June 31, Due date, Return

How to download paid TDS Challan and TCS Challan Details on E-filing

How To Download Income Tax Paid Challan From Icici Bank - TAX

Simple Way to Correct Critical Errors in TDS Challan